As chief advisor and CTO of Lotwork and HYCO, startup companies in logistics and supply chain solutions and technology, I’m often asked by investors and clients this question: How can a startup with limited funds and personnel manage to develop an ultra-low power ring scanner while the big companies with more money and employees could not?

My answer: Smaller companies are more agile when it comes to breaking conventional thinking pattens to achieve revolutionary innovation.

Having worked in senior technical team management in two Fortune 500 companies, I’ve come to the realization that large organization lack the singular drive and focus needed to handle interdisciplinary challenges.

Although large companies have many top talents, the division of labor is extremely delineated. But when it comes to finding a solution to a problem, the answer requires cross-collaboration. Unless the CEO is capable of driving the cross-disciplinary process, a company cannot effectively utilize its top talent to solve complex problems. On the other hand, in startups, the smaller team size and minimal communication friction makes it possible to coordinate all talents on board to tackle tough challenges.

Large companies also don’t have the urgent need to tackle difficult problems because they have other product lines and services that can financially sustain their operations. With all the risks involved in addressing complex challenges, top executives are often reluctant to take them on.

This lack of pressure and unwillingness to take risks are the main reasons why large companies struggle with revolutionary innovation. For those interested in learning more about this issue and gaining a deeper understanding, I would recommend reading Clayton Christensen’s book "The Innovator's Dilemma.”

So even though large companies have ample financial resources, top talent, and market capabilities, their inertia often leads them to let startups innovate. If these startups succeed, big companies can simply buy them out. This practice of acquiring startups with innovative technologies is common in Europe and America. No surprise, it’s a mainstream exit strategy for venture investments there.

In contrast, startups in Mainland China are less fortunate. That’s because large Chinese companies tend to directly poach technical talent from startups, sometimes even taking over the entire company. This is why Silicon Valley capital is willing to invest long-term in startups capable of revolutionary innovation, while investment in China often focuses on startups that adopt existing ideas from abroad.

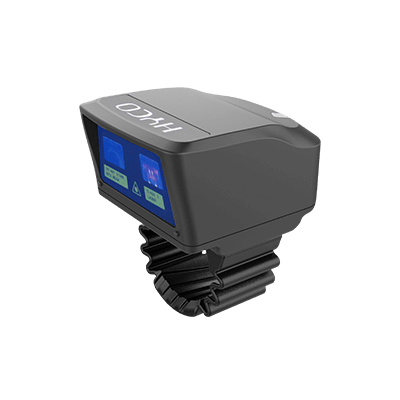

Thanks to 15 years of continuous innovation and tackling technical challenges, we are now building new industrial solutions based on an ultra-low power technology platform (ULPCP). Our technology lays a solid foundation for global leadership in ultra-low power ring scanners, ultra-low power Wireless Light Tags, wearable computing, and cloud personal digital assistants. Taken together, this technology should significantly enhance the efficiency and safety of North American logistics and delivery.